Automated Switching

Switch the core operating account. Establish primacy faster.

Onsetto Automated Switching is a business bank switching platform purpose-built to move the core operating account. Instead of relying on manual follow-ups and customer guesswork, banks can transition payroll, AR/AP, payments, and operating flows into newly opened accounts—achieving faster funding and earlier primacy.

Move payroll, AR/AP, and operating flows in days—not months.

Move the entire core operating account.

Onsetto identifies and updates the systems tied to a business’s core operating account, including revenue sources, vendors, payments, invoices, and payroll—ensuring the new account becomes the customer’s primary financial hub.

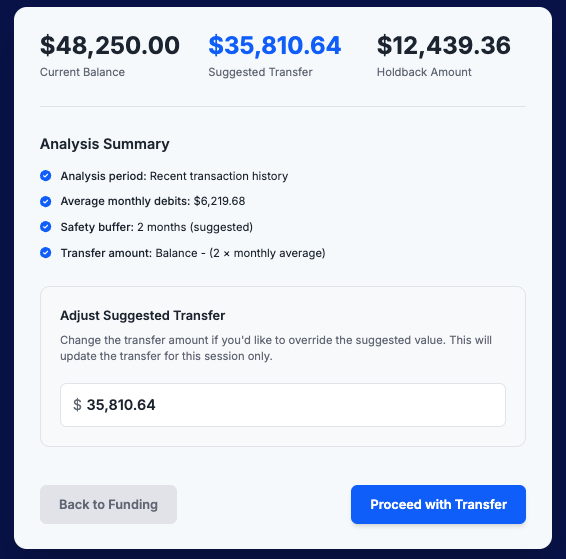

Accelerate core operating account funding.

Onsetto recommends initial deposit amounts based on observed operating activity—helping banks fund new accounts faster and move the relationship toward primacy more predictably.

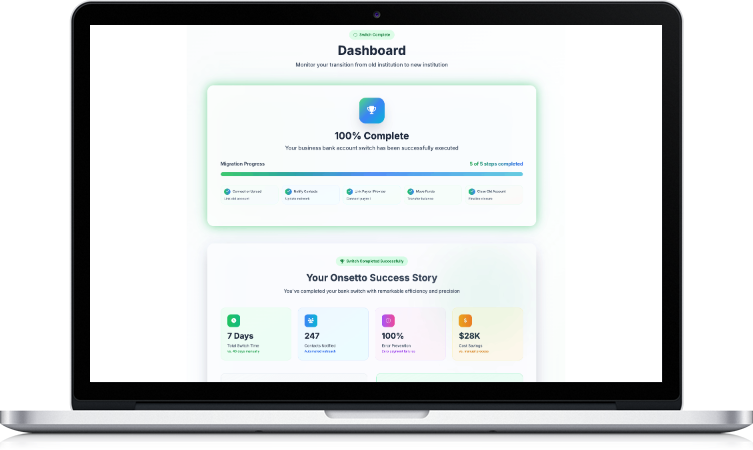

Visibility from onboarding to primacy.

Bankers see switching progress, outstanding tasks, funding readiness, and signals tied to core operating account adoption—all in one centralized dashboard.

Improve staff efficiency and operating leverage

Onsetto reduces the manual effort required to activate new business accounts. By replacing follow-ups, spreadsheets, and ad hoc coordination with a structured switching workflow, bankers spend less time managing transitions and more time building relationships.

For financial institutions, this translates to a stronger staff efficiency ratio. Teams can activate accounts faster, handle more relationships per banker, and improve operational productivity without adding headcount.

Remove friction when transitioning banker relationships

Onsetto makes it easier for business bankers to transition their book of business when changing institutions. Instead of relying on clients to reconfigure payroll, payments, and receivables on their own, Onsetto provides a guided, transparent process that minimizes disruption.

Financial institutions use Onsetto to attract experienced business bankers, accelerate onboarding, and reduce resistance tied to moving operating relationships—turning switching into a competitive advantage in hiring and growth.

Internal analysis shows that nearly 40% of newly opened business accounts do not become fully funded operating relationships

Designed to deliver measurable results.

Faster time to core operating account funding

Higher percentage of accounts achieving primacy

Increased treasury adoption

Fewer banker hours per onboarding

Not switching software. Growth infrastructure.

One fully activated operating relationship can generate enough interest income to pay for Onsetto many times over.

Deposits Moved × % NIM = ROI